Why Divest? A Focus on Financial Institutions

5 Reasons Financial institutions should divest from nuclear weapons producers

1. Nuclear weapons are inhumane. Financial institutions can have their own opinion, and do have their own opinion when it comes to what is allowable for them, and their clients to invest in. Financial institutions can decide not to invest in products that are inhumane by design.

2. There is a stigma attached to financing the bomb. No one wants to be known as a nuclear weapons investor, just as financial institutions don’t want to be known as investing in prostitution. There are some reputational risks that investors need to consider.

3. Consumers are going green. Around the world consumers are seeking ways to eco-label their activities, whether by purchasing fair trade products or shifting their investments towards socially responsible funds.

4. Nuclear weapons producers are financially neutral. For the most part, the return on investment from nuclear weapons producers is not significantly more or less than other industries and markets. There is no significant financial benefit, or loss, from divesting from these producers.

5. There exists a binding obligation to negotiate disarmament and eliminate arsenals. This obligation means that nuclear weapons production is not a viable long term industry. In addion, as of 22 January 2021, nuclear weapons are comprehensively prohibited under international law, as is any inducemnet or encouragement to continue manufacturing them.

How to find out if your institution is investing in nuclear weapon producers?

A logical first step is to look in the Don’t Bank on the Bomb report- organised alphabetically by financial institution. If they are not listed, just ask them directly. Sending a letter is more effective than scanning their websites, as unfortunately many banks, insurance companies and pension funds are not very transparent about their investments. Some institutions will give clients the impression they invest in a responsible way by showing general business principles like the UN Principles of Responsible Investment or a Code of Conduct. Since there is often a difference between business principles and business practice, general answers cannot guarantee any certainty over their business practice. Citing confidentiality issues, many financial institutions have gotten less and less transparent, this results also in a lack of accountability.

This lack of transparency plays a role on different levels. When contacting financial institutions, you can ask specific questions about each level:

- The policy level: What is the investment policy in relation to the arms industry or nuclear weapon producers?

- The implementation level: If there is a policy, there should be clear information about the way the policy is implemented. How is an institution performing?

- The transaction level: Stakeholders should be able to find the names and details of the major transactions a financial institution has carried out. What is this institution investing in?

A lot of the information is already available in the Don’t Bank on the Bomb report, at least for several hundred financial institutions. If you want to investigate institutions that are not in this report, or if you want to examine investments of less than 0.5% total share or bondholdings, it helps to have some basic understanding of the financial world and a lot of patience to go through a company’s annual reports, announcements to stock market authorities, press releases, business newspapers and magazines, etc. Unfortunately, the information you are looking for is not usually available for free – you need to pay to get access to expensive databases and search machines.

How to use Don’t Bank on the Bomb to find out if your bank invests in nuclear weapons

The Don’t Bank on the Bomb report does not include all companies involved in all aspects of nuclear weapons nor does it include every single financial institution that holds shares or bonds of these companies. The report does list the financial institutions that are most heavily invested in nuclear weapon producers, and can be useful for your own campaign in the following ways:

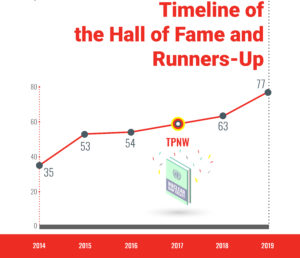

1) Take a look at the ‘Hall of Shame’ section of the report and search for financial institutions active in your country. Even if the headquarters of a bank is not located in your country, as long as they have subsidiaries in your country it is worthwhile to include them in your campaign. Subsidiaries may not decide upon the policy of the whole group, but they can influence policy in a positive way.

2) If the institution you want to target is not listed in this report, you may want to consider hiring a research company specialised in researching financial data. Like the company we used: Profundo (http://www.profundo.nl/). They have access to all the necessary databases and experience in finding nuclear weapons investments specifically. You will need to pay them for their services though.

3) The banks listed in the ‘Runners-up’ list might also be a good target. These financial institutions are on their way to be included in the ‘Hall of Fame’. They have already decided that there is something bad about investing in nuclear weapons. Our experience is that most of them are very easy to approach and willing to engage in exchanges of views. They may be convinced to make the amendments to their policies and practices that will get them in the Hall of Fame of the next Don’t Bank on the Bomb report, and fully divest from any nuclear weapon producer holdings.

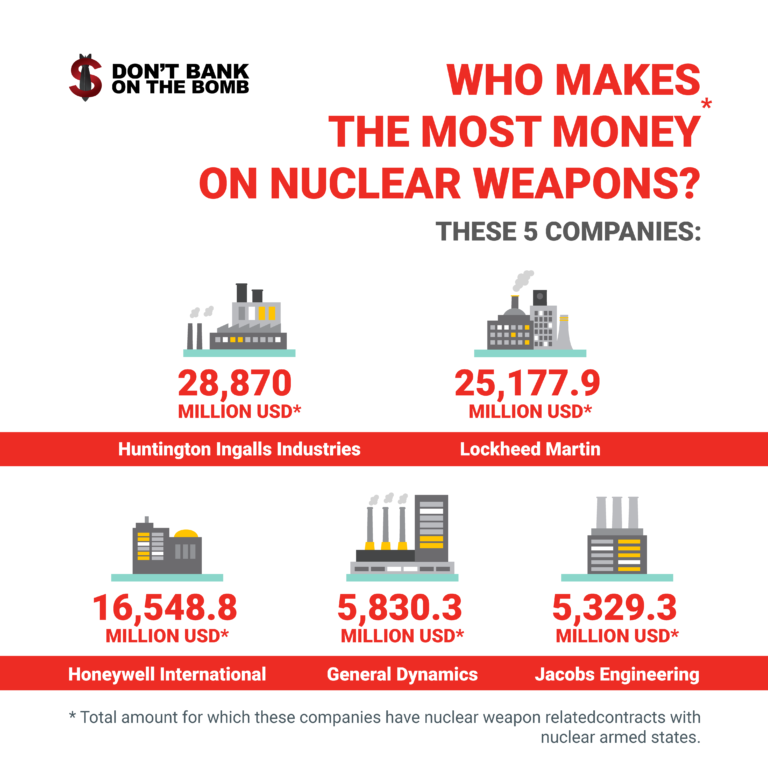

4) Read the more detailed information on how the financial institutions you are targeting are investing in nuclear weapon producer(s), and which ones. Take a look in the producer list to learn more about the producing companies and the role they play on maintaining and modernising nuclear weapons.

5) Take a look at the criteria used for the research. These criteria give you more information on how the research was carried out and will answer some questions you or others (financial institutions, media) may have.

6) Take a look at the ‘Hall of Fame’ to see which financial institutions have good policies on nuclear weapon producers. These policies are important examples for other financial institutions, and they are clear proof that ending financial involvement with nuclear weapon producers is possible. Policies that prohibit or limit investment in nuclear weapon producers are not limited to ethical banks alone- there are pension funds and mainstream banks and insurance companies with good policies as well!

IMPORTANT

It is important to look for all financial institutions active in your country, not only the ones which have their headquarters there. Campaigning efforts by other NGOs has shown that targeting subsidiaries can change policies of the whole group! For targeting a subsidiary in your country, it can be a good strategy to raise public awareness among the clients of the institution. But, as the policy is made on the group-level, it is important to communicate with the parent company headquarters directly. This means you should seek contact with persons responsible for the policies of the whole group. It is a good idea to put the persons responsible for the subsidiaries in copy of your communications so they are aware of your efforts and the issues you raise. This way, you involve the subsidiary in your action and you can pressure both sides: the subsidiary and the group.

If a financial institution is not listed in the Hall of Shame, it does not mean they are not investing in nuclear weapon producers. The Hall of Shame is a non exhaustive list. For the research in this report, we only look at investments in 30 nuclear weapons producing companies and only if the involvement is above a threshold of 0.50% for owning or managing assets of nuclear weapon producers. This means that the financial institutions which own or manage less than 0.50 % of assets of any of these 30 nuclear weapon producer are not listed. Also, it means that investments in other companies that may be involved in the production of nuclear weapons are not listed in this report. Extra research can reveal financial links not mentioned in this report. All of the financial institutions in the Hall of Fame however, have undergone an implementation check- none invest in any of the identified nuclear weapon producing companies.

The Don’t Bank on the Bomb report has given special attention to some public pension funds and sovereign wealth funds. These are particularly interesting because most of them are state owned. This becomes even more important when the Sovereign Wealth Funds (SWF) or Public Pension Funds (PPFs) home country has ratified a nuclear weapons free zone agreement. Moreover, SWFs and PPFs sometimes hold a substantial stake in the capital of companies. This gives them considerable voting power at annual meetings, and sometimes even one or more seats on the board of directors. If one of the listed funds is based in your country, this is a very interesting campaigning opportunity!

What are we asking financial institutions to do?

Develop a comprehensive policy against investing in nuclear weapon producers

Financial institutions should develop policies that exclude all financial links with companies involved in the production of nuclear weapons. Investment makes production possible. This means that no exceptions will be made for financial services on behalf of third parties, for funds that follow an index, for project finance for civil purpose of a company that is also involved in nuclear weapons, nor should it be a policy that only excludes project financing for nuclear weapons.

Inform the producer why they are divesting

Financial institutions should inform the producing company about the decision to end investments because of the company’s involvement with nuclear weapons. The financial institution can set clear deadlines within a limited time frame for the company to stop its activities related to the production of nuclear weapons, in order to reverse its decision to divest. In cases where a producing company continues it’s involvement in the production of nuclear weapons after the set deadline, the financial institution will have to divest until the producing company stops its involvement. New requests for investments will have to be declined therefore until the company has stopped all activities related to the production of nuclear weapons.

Apply the divestment policy to all activities

Financial institutions should apply their divestment policy to all their activities: commercial banking, investment banking and asset management. All of these activities actively assist a company in the production of nuclear weapons. In case this requires a policy change for investment funds, investors should have a deadline to sell their participation in these funds after notification of this policy change.

Who shall I target?

Campaigning on financial institutions and their investment policies includes contacting and meeting with people who work for these banks. But banks and investors are often huge companies with thousands of employees. So who do you need to talk to?

Try to climb as high as you can

Campaigning efforts are more effective if you are able to get in contact with members of the board of directors. If the board of directors gets involved in your topic, you are halfway there. Most of the time, it will be difficult to contact someone on the board of directors, so it is important to find people that are involved in the decision making process on policies relating to investments in nuclear weapon producers. Furthermore, the people you talk to should be in a position to influence internal company policies.

A rule of thumb: talk to the people in charge of the policy

The best situation is to have a meeting with someone responsible for commercial banking, and someone responsible for asset management. Figure out what financial products the company offers (issuances, loans, asset management, etc) and meet with the persons responsible for all of these. It is important to find someone who is interested in the nuclear weapon issue and both willing and capable to influence internal company policies.

Assess the situation with the bank that you are interacting with

Who you choose to talk to within the financial institution can have advantages and disadvantages for your campaign. Below are a few key departments and positions that you may want to consider targeting:

Sustainability department

Advantage: It will be easy to generate interest in the issue, and they know how to get sustainability or ethical issues on the internal agenda of the company.

Disadvantage: in some cases, sustainability departments are more about influencing the perception of the public than about influencing the behaviour of the institution. If a sustainability department is part of – or can only be contacted via – the companies communication department, that is often not a good sign (see below).

Investment managers

Advantage: If you can convince investment managers to consider divestment, you are halfway there. Investment managers are usually keen to avoid limits to their investment practices.

Disadvantage: You will have to be able to enter into complex technical discussions about practical problems to implement a divestment policy on nuclear weapons.

Communications department

Advantages: This department is often the first to feel pressure caused by public campaigns. They take responsibility for any damage to the image of their company, and therefore may be susceptible to proposals that can help to protect or improve the company image.

Disadvantages: Often, communication departments know very little about sustainability. They are mostly concerned with the image of the company. Often their goal is to reduce and manage the harm that you could potentially bring to them. They often use the “don’t target us” message.

How to respond to frequently heard reactions by financial institutions

Financial institutions will use several arguments to convince their clients, and you as a campaigner, that they are committed to doing their best on the issue. Below you can find a few tips on how to react to their arguments and how to ask the right questions.

Referring to general principles

Banks often refer to general principles when asked to their involvement with weapons producers: The UN Principles of Responsible Investment, their Code of Conduct, the Equator Principles, the Sustainable Report, etc. These documents show the bank’s commitment to ethical financing. Yet, subscribing to codes of conduct or principles does not mean they are implemented. These statements of intent are no guarantee for ethical investment. Asking how they implement this concretely can help. Conducting research on their investment practice can provide you with hard evidence as to whether these principles are fully implemented or not, and referring back to the ideals that encouraged them to sign up to the principles in the first place can encourage them to establish policies about nuclear weapons as well.

Corporate loans are not intended to finance nuclear weapons

Some financial institutions say that their nuclear weapons policy doesn’t apply to commercial banking services by stating that “a working capital facility is not intended to finance nuclear weapon production itself”. This means that their policy does not apply when they provide money for general corporate purposes, or that they have some sort of agreement with the producer that their money will not be used for these questionable activities . This is a major flaw, because a financial institution cannot guarantee that the financial services it provides to a company will not be used to produce nuclear weapons. It is common for weapons producers to finance their nuclear activities from their general corporate capital.

There is no way to prevent a company from reallocating capital. Adding stipulations to a general corporate loan prohibiting the companies’ use of the funds to produce nuclear weapons, or restricting the financing of a company to civilian projects, does not prevent the release of other funds which could then be used to finance nuclear weapons production.

Moreover, we have rarely come across project financing identified specifically for nuclear weapons facilities. Excluding only project financing specifically for nuclear weapons is therefore a hollow excuse, nuclear weapon producers can work around these policies by saying the funds will be used for general corporate purposes – freeing up other money for nuclear weapons production. A company producing nuclear weapons with the potential to cause devastating humanitarian, environmental and developmental consequences should not be a business partner.

Banks are neutral

Some financial institutions argue that financing or investing is a neutral activity. They claim to be neutral, therefore not able to choose sides, and obligated to offer the services their clients ask for. Investing in a company is clearly an active and supportive effort to raise the capital that is needed to fulfil the plans this company has made. Any financial service delivered to a company by a financial institution demonstrates approval of their activities. Moreover financial institutions provide crucial and necessary support to the company, so that it is able to carry out its projects. Investments are not neutral. In addition, it should be noted that prohibiting certain financial involvements is not something new or remarkable. Institutions are frequently bound by law to divest from companies that violate certain laws or regulations. For example regulations on child labour, environmental standards etc.

Nuclear weapon production is a marginal activity of the company

“Only 2% of the company’s turnover is related to the production of nuclear weapons”. The fact that it is only a marginal activity makes the company eligible for financial services and loans according to the policies of some financial institutions. But 2% of a company’s turnover can be a huge amount of financial support depending on the size and overall turnover of the company. Most companies that produce nuclear weapons are also involved in civil projects so this argument will mean that the majority of nuclear weapon producing companies would be eligible for investment from financial institutions under this policy. There is no such thing as proportional ethics!

It is impossible to check which companies are nuclear weapon producers

Asset managers sell and buy shares and bonds in many companies and claim that they do not have the means to check quickly and cost effectively if these are nuclear weapon producers. Close cooperation and information sharing with financial institutions with comprehensive policies, NGOs and non-financial or Socially Responsible Investment (SRI) advisors can result in clear and updated lists of companies showing which companies produce nuclear weapons. National legislation which includes a black list of companies that is updated frequently is another solution to this problem

The investments are made by subsidiaries, not by us.

It is important to look at the investments made by the group and the policy of the group. The investment policy is usually stipulated by the group. Revenues made by subsidiaries contribute to the revenue of the group. Moreover, it is difficult to control where money from the group is invested. In short, a banking group is responsible for the investments of all their subsidiaries. As a banking group always presents itself as a group in its communication to customers, it’s logical we look at them the same way.

The investments are for third parties, not for our own account

Several banks have a policy that only takes into account their own involvement, meaning that the policy only applies to the money a bank invests on its own behalf and does not apply to the money invested on behalf of its clients. This is a major flaw because a large amount of the money that a financial institution invests belongs to third parties.

It is also inconsistent for a financial institution to profit from selling investments in nuclear weapon producers to others, while not wanting to invest its own funds in nuclear weapon producers. By investing money that belongs to third parties banks facilitate the financing of producers of nuclear weapons.

Banks argue that they do not want to make ethical choices on behalf of their clients. This is a weak argument, considering that most banks refuse to be transparent about the companies they invest in. When a client is not informed about the companies a bank invests in, the client cannot make an informed choice.

We only allow investments by funds following an index

Most financial institutions make an exception for financial institutions following an index. These funds track a certain index and thereby invest in companies of this index. They argue that it is impossible to implement a divestment policy on these funds. Still, some financial institutions have a policy that follows index funds, showing that nothing is impossible.

Bank secrets

“We are bound by a duty of confidentiality. We can’t publish the names of the companies we’re investing in”. The duty of confidentiality is a duty that banks impose on themselves. There is nobody who forbids the publication of the names of the companies they invest in. Banks like Triodos and ASN stipulate the publication right in their contracts with companies. Banks like ASN have made a specific commitment to transparency and publish a list of companies on their website. Moreover, for investment funds, there is an obligation to publish investments included in the fund.

We engage with companies

Financial institutions argue that engagement is a positive approach towards harmful companies, and financial institutions often claim that setting up a dialogue with the company provides an opportunity for change. It is difficult to check the effectiveness of this policy, as most of the time there is no transparency about efforts to engage, which means it is impossible to know whether and in what way the engagement procedure is going.

The difficulties with these procedures are:

- In general, it is not clearly stated how a company needs to change, and more importantly by what deadline.

- Engaging with companies is fruitless without defined consequences if there is no change, and this is not always clear.

- Being an active shareholder so far hasn’t changed much in the company’s policy. Active ownership of banks often does not go further than asking for the company’s sustainability report, asking for more general information and asking for independent governors. These actions are far from demanding good policy or ending the production of nuclear weapons, or from threatening to restrain their money if nothing changes.

- Engagement can be used as an excuse to continue investment in companies that do not fit a bank’s policy on nuclear weapons.

We do not have a mandate from our clients

“Clients ask us to get the biggest revenue possible. They do not ask us to stop financing companies involved in nuclear weapons”. The reality of the situation is that banks decide where they invest their money, and since they are often not transparent about their investments, it is difficult for clients to know which companies are being financed. In reality, the majority of customers don’t want their money to be invested in producers of weapons of mass destruction. Financial institutions should implement transparent policies which enable customers to make an informed choice.

Referring to the person/committee responsible for implementing the policy

Having a person or committee responsible is a good sign. A good policy is still needed, since only comprehensive policies provide guidelines and procedures. Furthermore, implementing a policy is a way to be transparent to clients. Without a policy it is difficult to be accountable for your actions.

Clients have the option to choose sustainable products

Having a big supply of sustainable products does not restrain a bank from having investments in nuclear weapons. This argument means that a bank still considers investments in nuclear weapon producers as clean investments: a client can ask for nuclear weapon-free investments, but for the bank as a whole, it is still acceptable to invest in nuclear weapon producers. Even if the bank has sustainable products, that does not mean that those products do not invest in nuclear weapon producers, as they may not have clear and comprehensive policies either.

A lot of sustainable products invest in our institution

“Our institution is considered best in its class by several sustainable researchers”. This argument is not valid. Screening agencies of sustainable products often don’t set strong enough standards by the social, ecological and ethical components of the investment policy of the bank. The screening is mostly focused on the internal social and ecological policy of the bank for their own CO2 reduction, their staffing policy, etc. There are even some Socially Responsible Investment (SRI) products that don’t exclude investments in nuclear weapon producers at all.

Most importantly:

Please keep us informed about your actions and activities, so that we can share with other campaigners on the www.DontBankontheBomb.com website.